ANCHOR Marie Rock: This is Minnesota Native News. I’m Marie Rock. This week, we hear about the twenty-second annual Great Lakes Indigenous Farming Conference. Plus, important information for families about the Minnesota Department of Revenue’s Child Tax Credit.

First, let’s hear from Deanna Standing Cloud.

Deanna StandingCloud: According to the Ojibwe worldview, humans have an interconnectedness with the natural world around them, including all animals and plant life. This perspective is still upheld today and is the framework for the Annual Indigenous Farming Conference. Presented by the White Earth Land Recovery Project, the conference is celebrating its 22nd year.

Kaylee Carnahan: This is actually my fourth year attending, and I remember the first year I came, I was just blown away.

Deanna StandingCloud: Kaylee Carnahan works for Indigenous Environmental Network and is the lead organizer for their Teaching Garden located on their office grounds in Bemidji, Minnesota. Naturally attracting local pollinators, the garden serves as a healthy boost in the ecosystem and offers youth and community education on seed saving and Indigenous growing practices.

Kaylee Carnahan: With the teaching garden, you know, we do a lot of food sovereignty work.

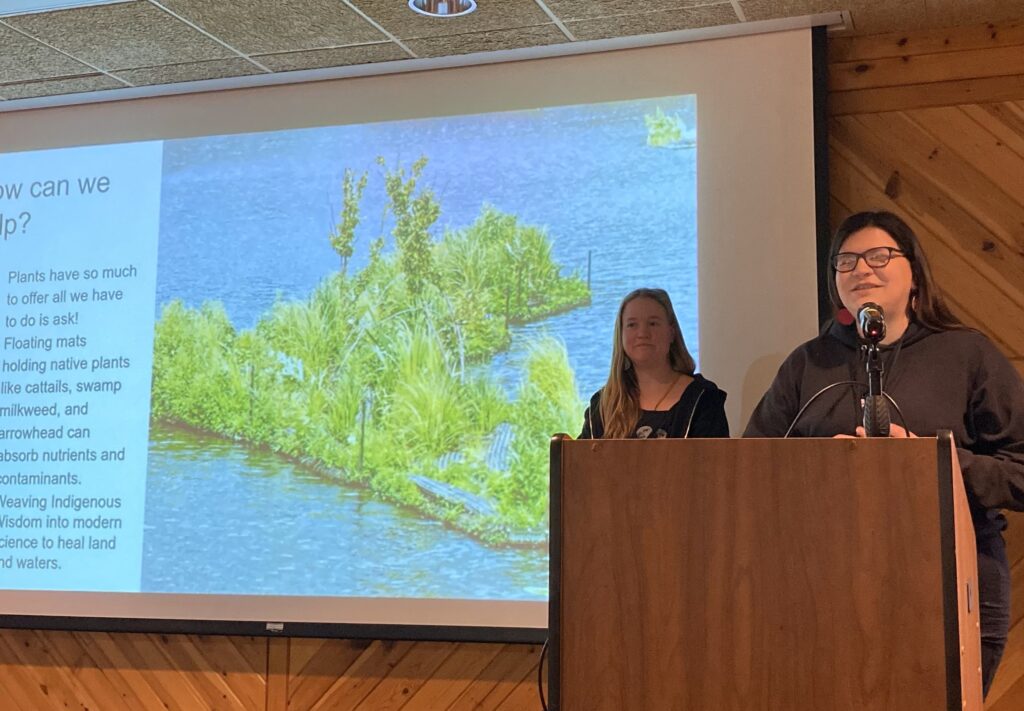

Deanna StandingCloud: Presenters at the Great Lakes Indigenous Farming Conference persist that our land in Minnesota needs to be honored and protected. Leanna Goose, Co-Facilitator for the Rise and Repair coalition shares about her work and kinship to the land.

Leanna Goose: In indigenous culture, we really understand, like our connection to the land is a big part of who we are.

Deanna StandingCloud: The conference has been held for the past three years at the Sugar Lake Lodge in Cohasset, Minnesota which offers a scenic view as participants learned from one another and networked. The conference included Indigenous vendors, cultural demonstrations, and community film viewings about building relationship to the land. For information, visit the White Earth Land Recovery Project at W E L R P dot org. For Minnesota Native News, I’m Deanna StandingCloud.

ANCHOR Marie Rock: Next, many tribal members might think they’re not eligible for the Child Tax Credit if they don’t file taxes. The Minnesota Department of Revenue wants families to know that this isn’t the case, and that this resource is available to them. Emma Needham has more.

Emma Needham: The April 15th filing deadline for federal and state taxes is fast approaching. The Minnesota Department of Revenue wants families — especially tribal members — to know about the Child Tax Credit.

PAUL MARQUART: It can go a long ways at reducing child poverty in the state of Minnesota.

Emma Needham: That’s Paul Marquart, the commissioner at the Minnesota Department of Revenue.

PAUL MARQUART: A family can qualify for up to $1,750 per child with no limit on the number of children. It is refundable credit, which means it can go past any tax liability you might have, and most will receive a refund.

Emma Needham: To get the Child Tax Credit, you need to file an income tax return. You don’t have to owe taxes in order to get this money. And, you can extend beyond April 15th without a penalty if you are getting a refund.

PAUL MARQUART: We recognize that many tribal members are not required to file an income tax return. And so we really encourage tribal members who would qualify for the Child Tax Credit to consider filing a tax return to get this credit. Basically, all the filers have to do is file that income tax form, and you can receive that credit.

Emma Needham: To get the maximum credit, the income requirements are about $37,000 total income for joint filers, and about $31,000 for single income households.

PAUL MARQUART: If you have four children, you can qualify for some of the credit all the way up to almost $100,000.

Emma Needham: Children up to age 17 qualify. The credit is also available for higher earner households but at a reduced amount. This year, the Minnesota Department of Revenue is allowing filers to also receive half their Child Tax Credit for the next year as well.

PAUL MARQUART: You can get payments not just when you file your taxes and receive that refund, but later in the year you can receive up to 50 percent of your credit in three equal installments.

Emma Needham: Paul says that filing electronically is often the easiest

PAUL MARQUART: You can go to “electronic filing” on our website to do that. But also you can find where there are some free tax preparation sites.

Emma Needham: More information is at REVENUE dot STATE dot MN dot US.

PAUL MARQUART: Last year, about $560 million went out to about 225,000 families and benefitted about 450,000 children.

Emma Needham: For Minnesota Native News, I’m Emma Needham.

ANCHOR Marie Rock: [outro credits]

More from Minnesota Native News

- Great Lakes Indigenous Farming Conference & the Minnesota Department of Revenue’s Child Tax Credit

ANCHOR Marie Rock: This is Minnesota Native News. I’m Marie Rock. This week, we hear about the twenty-second annual Great Lakes Indigenous Farming Conference. Plus, important information for families about the Minnesota Department of Revenue’s Child Tax Credit. First, let’s hear from Deanna Standing Cloud. Deanna StandingCloud: According to the Ojibwe worldview, humans have an interconnectedness with …

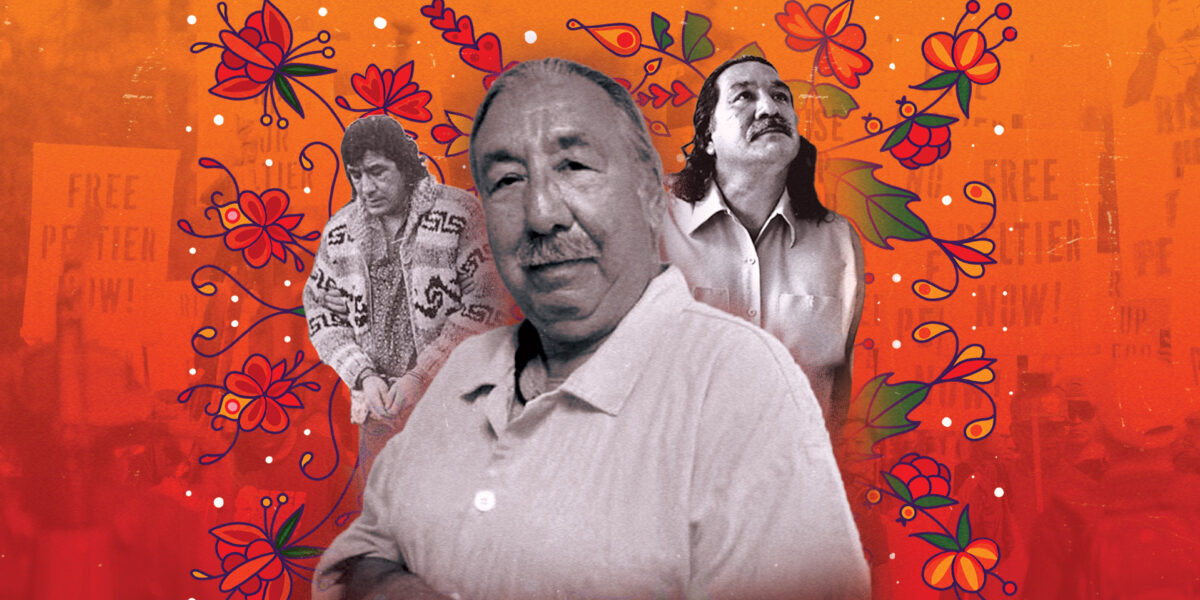

ANCHOR Marie Rock: This is Minnesota Native News. I’m Marie Rock. This week, we hear about the twenty-second annual Great Lakes Indigenous Farming Conference. Plus, important information for families about the Minnesota Department of Revenue’s Child Tax Credit. First, let’s hear from Deanna Standing Cloud. Deanna StandingCloud: According to the Ojibwe worldview, humans have an interconnectedness with … - Leonard Peltier’s Homecoming

ANCHOR Marie Rock: This is Minnesota Native News, I’m Marie Rock. This week, we hear about AIM activist Leonard Peltier’s recent homecoming celebration. Plus, current events affecting Indigenous nations here in Minnesota. First, let’s hear from Emma Needham. Emma Needham: One month into his Clemency granted by the Biden Administration, Leonard Peltier was welcomed home last …

ANCHOR Marie Rock: This is Minnesota Native News, I’m Marie Rock. This week, we hear about AIM activist Leonard Peltier’s recent homecoming celebration. Plus, current events affecting Indigenous nations here in Minnesota. First, let’s hear from Emma Needham. Emma Needham: One month into his Clemency granted by the Biden Administration, Leonard Peltier was welcomed home last … - Indigenous state-wide climate justice

ANCHOR Marie Rock: This is Minnesota Native News, I’m Marie Rock. This week, an update on the 20-year battle over Minnesota’s first copper-nickel mine. Plus, a local Indigenous-led coalition pushes for climate justice at the state legislature. First, let’s hear from reporter Vincent Moniz. Vincent Moniz: In November 2024, the Minnesota Department of Natural Resources delayed …

ANCHOR Marie Rock: This is Minnesota Native News, I’m Marie Rock. This week, an update on the 20-year battle over Minnesota’s first copper-nickel mine. Plus, a local Indigenous-led coalition pushes for climate justice at the state legislature. First, let’s hear from reporter Vincent Moniz. Vincent Moniz: In November 2024, the Minnesota Department of Natural Resources delayed …

Subscribe to Minnesota Native News in your favorite podcast app

Allison Herrera, Indigenous Affairs Journalist and author of Tribal Justice: The Struggle for Black Rights on Native Land

Allison Herrera, Indigenous Affairs Journalist and author of Tribal Justice: The Struggle for Black Rights on Native Land